– When will I get my stimulus check?

– Americans should file tax returns early to get Covid bill cash

– Read more articles on stimulus checks

– What is Biden’s next stimulus proposal?

A FOURTH round of stimulus payments could be included in President Joe Biden’s next coronavirus relief package.

Biden is currently working on two stimulus proposals, which currently focus on creating jobs and supporting families respectively.

However, many are hopeful that additional stimulus checks and student loan forgiveness will also make the cut.

In his speech to the joint session of Congress last week, President Biden praised the impact of stimulus checks but did not comment on whether there would be more of them in the future.

Read our stimulus live blog for the latest on Covid relief money…

-

DIRECT CASH PAYMENTS ARE WORKING

Economic Security Project, a nonprofit group, argued that recurring stimulus checks will decrease poverty.

The group previously said on Twitter, as they argued for recurring stimulus checks.

“Cash has been the leading force in reducing poverty during one of the deepest recessions in modern history,” the group said in a recent report.

Having recurring payments is “one of the only policies that can narrow persistent imbalances in poverty, income, and wealth between Americans of color and white Americans,” the nonprofit added.

-

EARLY TAX FILERS MAY GET EXTRA CASH

For Americans who filed their taxes early this year, extra cash may be on the way in the form of a bonus check or what’s known as a plus-up payment.

According to the IRS, Americans who received a stimulus check based on their 2019 tax returns might be eligible for more money once their 2020 return has been processed.

The additional “plus-up payments” will be sent to those whose economic situations changed between 2019 and 2020.

If their newest tax filing shows a drop in annual income or a new child or dependent, then more money could be on the way.

This particularly applies to those who didn’t qualify for the full $1,400 check in the third round of stimulus based on returns from 2019, but do for their 2020 returns.

It will also apply to Americans who got married in 2020 and filed a joint return for the year, with an adjusted gross income of less than $150,000.

If an individual wasn’t required to file taxes in previous years but did this year, then more money may also be on the way for them too.

-

HOW TO TRACK TAX REFUND

In March, the Internal Revenue Service (IRS) extended the tax return deadline from April 15 to May 17.

Yet it’s a good idea to file your return sooner rather than later, as it’ll ensure some Americans get a fourth stimulus check worth $1,400.

The latest data by the IRS show that the average tax refund was $2,873 in the week to April 26, compared with $2,939 for those who filed online.

It comes as almost 111 million tax returns have been filed so far, of which 73.3million households are due refunds.

You can see where your money is 24 hours after you’ve filed your tax return by logging into the IRS’ Where’s My Refund tool.

To do this, you’ll need to enter your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), which is shown on your tax return.

You’ll also need to enter your filing status and refund amount shown on your tax return – make sure it’s the exact amount shown to get the most accurate information.

You will then be taken to a page that will show you where your refund is.

-

WEST VIRGINIA GOV. WANTS TO GIVE PEOPLE STIMULUS TO GET VACCINATED

West Virginia Gov. Jim Justice is planning to give young people in his state money to get the Covid-19 vaccine, saying the move is “patriotic.”

The state will give residents between the ages of 16 and 35 a $100 savings bond after Justice said they had “hit a wall” when it came to vaccination efforts.

The reason we hit a wall is you’ve got 16 to 35-year-olds that are reluctant, you’ve got the Johnson & Johnson situation, and then, to be perfectly honest, you’ve got some hard-headed people,” Justice told Yahoo! Finance last week.

The governor said that the goal is to incentivize young people who may feel that they do not need the vaccine to help the state reach the goal of vaccinating 70 percent of its population.

-

BIDEN’S NEW PLAN MAY LAND YOU $14.8k in PAYMENTS

President Joe Biden’s America Families Plan, should it pass in Congress, would save the average family $14,800 per year in child care costs, among other proposed benefits.

According to a summary of the plan from the White House, “When fully implemented, the President’s plan will provide 3 million children from low- and middle-income families with high-quality care.”

The plan will also expand federal child tax credit, which will provide families $3,600 over the course of a year for children under age 6 and $3,000 for children six years and up.

Families will get that money in the form of what are essentially stimulus checks, sent out monthly by the IRS starting in July.

-

WHITE HOUSE AND SENATORS WEIGH AUTOMATIC STIMULUS RELIEF

Senators and the White House are reportedly considering setting up automatic relief for the next time the economy comes into significant distress.

The Economic Security Project briefed 50 staff members from the Senate Finance Committee on automatic stabilizers on Tuesday, which would tie the issuance of expanded unemployment payments and stimulus checks to the state of the economy.

The organization has also spoken with the Biden administration and is hoping the president includes the measure in one of his future relief bills.

-

WHITE HOUSE: IRS LETTER ON STIMULUS CHECKS NOT MEANT TO BE ABOUT BIDEN

During a press conference on Friday afternoon, White House Press Secretary Jen Psaki defended a letter that President Joe Biden sent to tens of millions of recipients of the third round of stimulus relief.

The letter is “pretty standard” and was “not intended to make it about him,” Psaki told reporters. “It’s about the American people.”

Psaki claimed the letter “goes out with physical checks,” but people who got the federal aid through direct deposit have also received the letter.

She also said that Biden chose not to sign the third round of checks because there were concerns it would cause a delay to the payments being sent out.

-

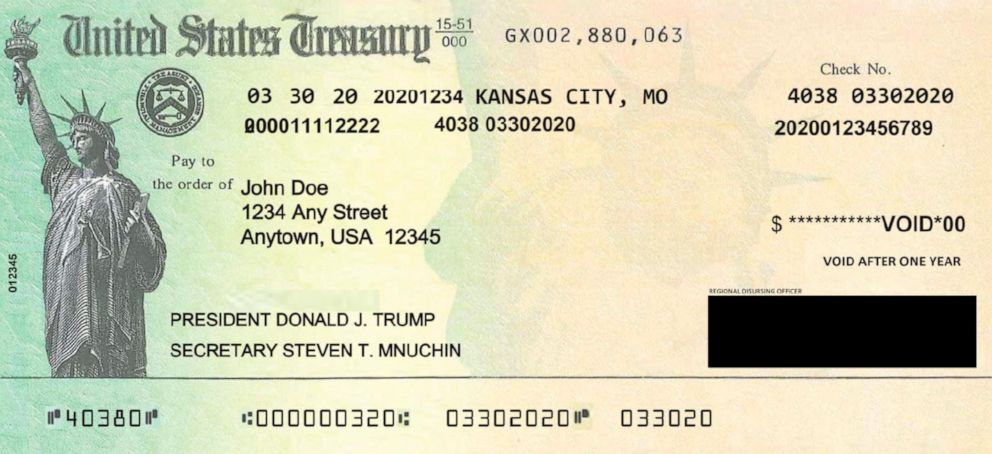

HOW TRUMP’S SIGNATURE CAME TO APPEAR ON STIMULUS CHECKS

A new report by ABC News has revealed how Donald Trump’s signature came to be printing on stimulus checks sent out to Americans last year.

“President Donald J. Trump” appeared below the words “Economic Impact Payment” on the memo line of the final version of the checks.

The inclusion of the scrawl sparked controversy at the time.

Critics accused Trump of attempting to take sole credit for the relief program.

CREDIT: ABC -

MORE STIMULUS CHECKS ON THE WAY

An eighth batch of $1,400 stimulus checks have been sent out by the IRS as part of the America Rescue Plan.

On Wednesday, the IRS informed that it had sent more than 1.1 million payments this time, amounting to over $2 billion.

Of this round of payments, around 600,000 will be made by direct deposit while the remaining 500,000 will come in paper form.

Since the approval of the coronavirus stimulus package in March, the IRS has now issued about 164 million payments amounting to around $386 billion.

The latest batch also includes over 570,000 “plus-up” payments, amounting to about $1 billion.

The “plus-up” payments are for those who already got the stimulus check, but the IRS found them to be eligible for more money after processing their latest tax return.

-

CALIFORNIA SENDS OUT $1.8 BILLION IN STIMULUS CHECKS

The state of California has sent out more than 2.5 million stimulus checks since April 15.

The Golden State Stimulus created a statewide direct payment plan that enabled the Franchise Tax Board to send out $600 or $1,200 payments to eligible individuals.

The program is designed to help low-income Californians and those who weren’t eligible to receive the direct payments passed by Congress under the America Rescue Plan.

“We passed the recovery package to get money into the pockets of Californians who were hit hardest by this pandemic, and that’s exactly what the Golden State Stimulus is doing—already getting $1.6 billion to 2.5 million Californians,” Governor Gavin Newsom said in a statement.

-

SOME NEW YORKERS MIGHT HAVE TO PAY BACK EXTRA UNEMPLOYMENT BENEFITS

A “small portion” of New Yorkers received duplicate payments as employees rushed to send them as quickly as possible, the New York State Department of Labor announced.

But now those who received excess money in April and May 2020 must return the extra cash as “under federal law, NYS DOL is required to recover any overpaid funds,” the department tweeted.

The number of people who could potentially be left out of pocket was not immediately clear, but a Labor Department spokesman confirmed the overpayment was part of the extra $600 government handout given early last year.

Around 40 million Americans received unemployment benefits last year, a package that was boosted by Covid relief bills and executive orders.

Those affected will be notified by letter – which will also include instructions on how to request an appeal or a waiver for authorities to forgive the balance.

-

PARENTS CAN GET UP TO $16,000 IN CHILDCARE EXPENSES

Parents will be able to claim up to $16,000 in childcare expenses through the American Rescue Plan.

Passed in March, the plan will temporarily expand the childcare tax credit, allowing for parents to claim the expenses when they file their 2021 taxes.

Parents can claim up to $8,000 for one child or up to $16,000 for multiple kids, claims Garrett Watson, senior policy adviser analyst at The Tax Foundation.

To qualify, your household’s gross income must be less than $125,000 otherwise the tax credit will phase out at 50 per cent.

For incomes above $183,000, the tax credit phases out at 20 per cent and remains at that level for incomes below $400,000.

The rate is phased out completely for households earning $438,000 and above.

Parents will not be able to claim the deduction until next year when 2021 tax returns are filed.

-

HOW TO GET $10,200 TAX BREAK IF YOU RECEIVED UNEMPLOYMENT

If you received unemployment insurance benefits in the US in 2020 and paid taxes on the benefits, you may be eligible for an additional refund from the IRS.

The American Rescue Plan Act included a $10,200 tax exemption that gives people who paid on those benefits a tax break on the unemployment benefits they received, at least for federal taxes.

The IRS is set to refund money to people who filed their tax returns before the unemployment tax break changes in the Plan regarding the exempt UI taxes went into effect.

If you are owed money thanks to this tax exemption and due to having already completed your tax return, the IRS will send you the money automatically.

You do not need to file an amended return in order to get this potential refund.

-

HERE’S WHY YOU MIGHT STILL BE WAITING FOR A THIRD STIMULUS CHECK

If you still haven’t received your third stimulus check, don’t fret — the IRS is still sending some of them out to certain Americans.

“If you haven’t received one yet, it doesn’t mean you won’t,” the IRS website says.

“Each week we’re sending the third payments to eligible individuals as we continue to process tax returns.”

-

WILL BIDEN’S RELIEF PROPOSALS INCLUDE STUDENT LOAN CANCELLATION?

President Joe Biden has previously supported canceling some student loan debt, and people are keeping an eye on his stimulus relief programs to see if loan forgiveness is included.

Neither the American Jobs Plan or the American Families Plan currently includes student loan forgiveness, but Biden has previously supported forgiving $10,000 in student loans.

The President recently asked his education secretary if he has the executive power to cancel up to $50,000 in student loan debt.

-

AMERICANS TURN DOWN 1.2 MILLION STIMULUS PAYMENTS

The IRS is currently sitting on roughly $2.1 billion in payments that were never accepted by their intended recipients.

Of the 164 million payments that were sent out in the first round of stimulus following the passage of the America Rescue Plan in March, about 1.25 million have never been cashed or were returned or paid back to the US Treasury.

Pennsylvanians, Vermonters, Montanans and Michiganders—three blue states and one red—were the most likely to leave their money on the table, Newsweek reported.

Arizonans and Texans were the least likely to pass up the stimulus payments, according to the outlet.

-

AMERICANS SUPPORT RECURRING STIMULUS PAYMENTS, IS ANOTHER CHECK ON THE WAY?

A January survey conducted by Data for Progress found that 65 percent of Americans support recurring monthly payments of $2,000 for the remainder of the pandemic.

But President Joe Biden has not committed to sending out a fourth round of stimulus checks.

Some Americans are still awaiting a third stimulus check, which the IRS says can still be claimed in they file with tax returns soon.

-

EARLY TAX FILERS MAY GET EXTRA CASH

For Americans who filed their taxes early this year, extra cash may be on the way in the form of a bonus check or what’s known as a plus-up payment.

According to the IRS, Americans who received a stimulus check based on their 2019 tax returns might be eligible for more money once their 2020 return has been processed.

The additional “plus-up payments” will be sent to those whose economic situations changed between 2019 and 2020.

If their newest tax filing shows a drop in annual income or a new child or dependent, then more money could be on the way.

This particularly applies to those who didn’t qualify for the full $1,400 check in the third round of stimulus based on returns from 2019, but do for their 2020 returns.

It will also apply to Americans who got married in 2020 and filed a joint return for the year, with an adjusted gross income of less than $150,000.

If an individual wasn’t required to file taxes in previous years but did this year, then more money may also be on the way for them too.

-

WEST VIRGINIA GOV. WANTS TO GIVE PEOPLE STIMULUS TO GET VACCINATED

West Virginia Gov. Jim Justice is planning to give young people in his state money to get the Covid-19 vaccine, saying the move is “patriotic.”

The state will give residents between the ages of 16 and 35 a $100 savings bond after Justice said they had “hit a wall” when it came to vaccination efforts.

The reason we hit a wall is you’ve got 16 to 35-year-olds that are reluctant, you’ve got the Johnson & Johnson situation, and then, to be perfectly honest, you’ve got some hard-headed people,” Justice told Yahoo! Finance last week.

The governor said that the goal is to incentivize young people who may feel that they do not need the vaccine to help the state reach the goal of vaccinating 70 percent of its population.

-

PARENTS WHO SHARE JOINT CUSTODY OF KIDS ARE ELIGIBLE FOR CHILD TAX CREDIT PAYMENTS

Parents who share joint custody of their kids are eligible to get expanded child tax credits payments under President Biden’s COVID-19 relief package.

Coming as part of the landmark $1.9 trillion America Rescue Plan, which was signed into law in March, the payments will begin in July and continue to be sent out monthly until December.

Every household with children that qualified for the latest $1,400 stimulus check is set to receive the child credit cash.

Such households include couples who earn less than $150,000 or an individual who earns less than $75,000.

Families with children under the age of six are eligible for up to $3,600 in payments per child.

Those with kids aged between six and 17, meanwhile, will be eligible for $3,000 in credit for each qualifying child.

Additionally, those with dependents between the ages of 18 and 24 who are enrolled in college full-time can receive $500 for each.

-

HOMEOWNERS CAN GET $3k IN MORTGAGE RELIEF

Homeowners can get more than $3,000-a-year in mortgage relief thanks to stimulus aid.

The Mortgage Stimulus Program is designed to help average US citizens as well as stimulate the economy.

Homeowners could get up to $307 a month, equivalent to $3,252 a year.

The money can go towards various expenses such as home improvements, remodels, debt or other bills.

Only single-family homes are eligible and apartments and mobile homes are excluded.

-

CLOSE TO 30 MILLION AMERICANS’ TAX RETURNS ARE DELAYED

The IRS is sending out notices to 29 million Americans telling them they should expect a delay in their tax returns.

The agency, which has received 91 million tax returns for 2020 so far and has returned some 68 million of them, is slammed during the tax season, warning taxpayers they might have longer than usual waittimes.

It usually takes about three weeks to get a tax return, but the IRS is working on sending out the latest batch of the third stimulus check to Americans, just as it returns to its offices since shutting down last year.

-

IRS STILL SENDING OUT THIRD ROUND OF STIMULUS CHECKS

If you have not yet received the latest $1,400 stimulus check payment, the IRS is recommending you file your tax returns before the May 17 federal tax filing deadline.

If the Service determines you’re entitled to the stimulus money, you should still be able to claim it and receive it soon.

Americans who make $75,000 or less if filing as a single person — or $112,500 or less if filing as a head of household, or $150,000 if filing as married and jointly — should be eligible to receive a stimulus check.

-

BIDEN’S NEXT STIMULUS PACKAGE COULD CANCEL $10,000 OF STUDENT DEBT

President Joe Biden is working on two new stimulus packages that could potentially cancel upwards of $10,000 of federal student loan debt.

In his speech to the joint session of Congress last week, President Biden praised the impact of stimulus checks but did not comment on whether there would be more of them in the future.

“We kept our commitment — Democrats and Republicans — of sending $1,400 rescue checks to 85 percent of American households,” Biden said. “For many people, it’s making all the difference in the world.”

People are also looking for $10,000 in cancelled student loans, a proposal Biden has previously supported.

While neither plan currently includes student loan forgiveness, Biden recently asked his education secretary if he has the executive power to cancel up to $50,000 in student loan debt.

-

GOLDEN STATE RELIEF

Some Californians haven’t received one of the $1.6billion stimulus checks rolled out in The Golden State.

Since April 15, around 2.5 million relief payments have been sent out but people who haven’t gotten one yet could still be eligible.

The statewide direct payment plan, created to help low-income residents and people who didn’t qualify for the federal check, allowed the Franchise Tax Board to roll out $600 or $1,200 payments.

If you are eligible and still waiting on your state stimulus check, simply make sure to file your taxes.

Firstly, to qualify, you need to be a California Earned Income Tax Credit (CalEITC) recipient earning less than $30,000 per year, or file your taxes with an Individual Taxpayer Identification Number (ITIN).

If both of these apply, your Cali check will amount to $1,200, reported Newsweek.

Click HERE to find out more.